Not ready to invest yet?

Sign up for our newsletter to stay up to date on Meridian’s offering, company, and industry news.

Sign up for our newsletter to stay up to date on Meridian’s offering, company, and industry news.

Diversify your portfolio with quarterly distributions from hard assets while supporting veterinary care. Aiming for a 12.5-15% overall IRR.*

INVEST NOWInvestors over $50,000 who want to invest with the aid of one of our Dallas-based team members click here.

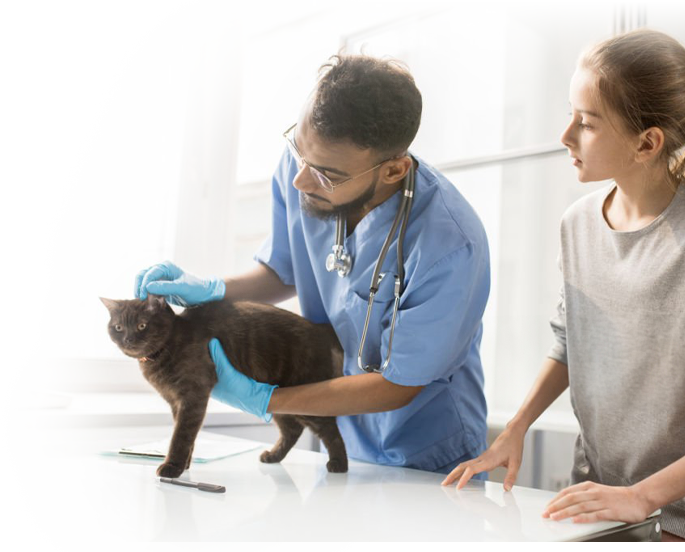

At Meridian, we focus on developing and owning state-of-the-art specialty veterinary hospitals operated by our client partners. These facilities offer advanced care including, ER services, orthopedics, eye care, cardiac care, oncology, neurology, imaging, and internal medicine—addressing a critical gap in the market.

In addition to specialty hospitals, we aim to generate income for our investors through the development of animal care facilities, including but not limited to dog daycare, boarding, and kennels.

The veterinary healthcare industry is projected to nearly double by 20321, and we aim to participate in this growth by meeting the rising demand for services provided in specialized hospitals.

Unfortunately, these essential facilities remain scarce, leaving many families struggling to find the care their pets need.

That’s where Meridian steps in. We’re addressing this gap by expanding access to specialty veterinary care, helping to ensure that when a pet is in need of specialty care, families can find the help they need.

With two successful funds already behind us, we’re proud to announce the launch of Meridian Veterinary Fund III, LLC—an opportunity to make a meaningful impact while capitalizing on a growing industry.

1Global Market Insights. (Aug 2024). Veterinary services market size, 2024: Industry analysis report. Retrieved December 12, 2024, from https://www.gminsights.com/industry-analysis/veterinary-services-market

At our core, we are pet lovers with a passion for creating state-of-the-art specialty veterinary hospitals and other pet wellness facilities. With extensive experience in commercial real estate, we’ve turned our focus to addressing a critical gap in veterinary care.

Meridian’s journey began when our founder, originally working in commercial real estate focused on human healthcare, encountered a personal challenge. His beloved Rottweiler, Tutt, was diagnosed with cancer, and accessing specialty care required driving for hours for each appointment.

This firsthand experience revealed the pressing need for more easily accessible specialty pet healthcare services.

Motivated by Tutt’s story, Meridian pivoted its focus to develop specialty veterinary hospitals—ensuring that families and their pets have access to the high-quality care they deserve.

Meridian affiliates currently own approximately 350,000 square feet of specialty veterinary hospital facilities.

Meridian begins development only after securing a triple net, or other lease, with a high-performing specialty veterinary practice seeking expansion or relocation. The operators commit to the project, paying rent, purchasing equipment, and maintaining the facility. This partnership begins with an operator seeking a facility that is supported by the revenues of the practice and the operator’s investment of millions of dollars in specialty equipment tailored to the space. We begin work based on specific demand enabling a seamless and efficient process for both our partners and investors.

At Meridian, we partner with top veterinarians to:

Repurpose and expand existing hospitals.

Acquire facilities needing renovation and/or expansion.

Purchase properties with long-term leases already in place.

Execute ground up development.

Invest in pet wellness facilities, including but not limited to imaging, dog daycare, boarding, and kennels.

Our investment approach ensures that every practice meets these high standards:

A strong team of veterinarians.

Practice operations exceeding specific lease coverage thresholds relative to the lease payment.

Located in or within 20 miles of a top 100 metropolitan area.

Positioned in a market with a substantial population of pet owners lacking local access to specialty care.

At Meridian, we act as orchestrators, first collaborating with veterinary operators that require advanced hospital-level diagnostic and surgical facilities but lack the real estate expertise or the time to develop them. We then, working in tandem with the operator, identify locations where a specialty veterinary hospital will benefit pet families and investors alike.

With signed leases in place, we construct state-of-the-art facilities, while our clients invest millions of dollars in custom-fitted surgical and diagnostic equipment. This creates a mutually beneficial partnership and solidifies a long-term relationship.

In most instances, Meridian’s veterinary operator partners sign Triple Net Leases, a rental agreement where tenants are responsible for operational expenses, including building maintenance, property taxes, and insurance. This structure allows Meridian to focus on collecting rent and passing income on to investors without absorbing the costs or labor related to property upkeep.

In fact, no Meridian tenant has ever defaulted on their lease, even during challenging times like COVID.

$50

Million

Aiming for an 8% Annualized Return Delivered Quarterly, Plus Growth

12.5-15%

Annualized

100% to Investors Until an

8% Preferred Return, Distributed Quarterly is Achieved + Return of Capital

70% to Investors

30% to Sponsors

C Corp

Investments will be financed at 60%-65% of the Total Project Cost

Refinancing at Stabilization Recapitalization

$5,000

Est. 3-5 Years

Thompson Hine

Setapart Accountancy Corp

DealMaker

DealMaker

CURT BOISFONTAINE, CEO

Mr. Boisfontaine founded Meridian Realty Advisors, L.P. in 1994 and has been in real estate since 1982. He is the sole Director of Meridian’s affiliated entities and is President of Meridian Capital Corporation. In 2016, after 25 years in healthcare-related real estate, he shifted Meridian’s focus to veterinary investments, assembling a ~$200 million portfolio of specialty hospitals. He also manages Meridian Veterinary Capital, LLC and LexaGene Life Sciences Manager, LLC. Mr. Boisfontaine serves on the board of Operation Kindness, a Dallas-based animal welfare non-profit, and operates a life-saving animal shelter that offers programs to assist people and pets.

He was raised in New Orleans, Louisiana, and holds a B.S. in Economics from Tulane University.

DAVID K. RONCK, PRESIDENT

Mr. Ronck is the President of Meridian Veterinary Capital, LLC, and oversees its daily operations, bringing 25+ years of experience in finance, operations, and capital markets to the table. Since joining in 1995, he’s held multiple roles, managing project capitalization and financing for Meridian’s veterinary hospitals and other projects. He and Curtis Boisfontaine are the principal partners of Meridian and its investment entities.

David holds a B.S. in Accounting from Oklahoma State University, serves on the school's Foundation Board of Governors, and is a past Alumni Association Board member. He is also a CPA in Texas.

JP RINDT, DIRECTOR

Mr. Rindt has worked in real estate since 2009. He began at MIMCO Inc., leasing over 300 properties across Texas and New Mexico. In 2013, he moved to Dallas, handling asset management and leasing for a real estate developer in the Dallas/Fort Worth Metroplex. From 2014 to 2019, he was at Xite Realty, leading growth strategies, site selection, and lease negotiations for healthcare practitioners, overseeing corporate accounts that achieved significant year-over-year growth.

Mr. Rindt is a native of El Paso, Texas, and holds a BBA in Finance and Real Estate from Baylor University.

CARTER BOISFONTAINE, DIRECTOR OF CAPITAL MARKETS

Mr. Boisfontaine is an investment professional with expertise in venture capital, corporate finance, and strategic transactions, overseeing $500 million+ in deals for both startups and fundraisers. Before Meridian, he led a $1 billion growth fund at Pegasus Tech Ventures, a VC firm with $2 billion in AUM, investing in companies like SpaceX and SoFi. As Senior Manager of Corporate Development at Bird Global, he secured $200 million in private financing.

Passionate about veterinary real estate, Carter is committed to creating spaces that support animal well-being. A proud dog dad to Hurley, his 4-year-old golden retriever, his love for animals drives his work.

Founded in 1994, Meridian is a full-service real estate investment management and advisory firm based in Dallas, Texas. Over the years, Meridian has sponsored and managed diverse real estate investments, including veterinary specialty hospitals, multifamily properties, retail shopping centers, for-sale condominiums and townhomes, office buildings, and senior living facilities.

Since its inception, Meridian has participated in the acquisition and disposition of more than $1 billion in real estate assets and portfolios. Today, the firm manages an investment portfolio with an aggregate value exceeding $250 million. In collaboration with its investment partners, Meridian has deployed over $400 million in equity across sponsored real estate ventures, resulting in the acquisition and development of assets in 14 states across the U.S.